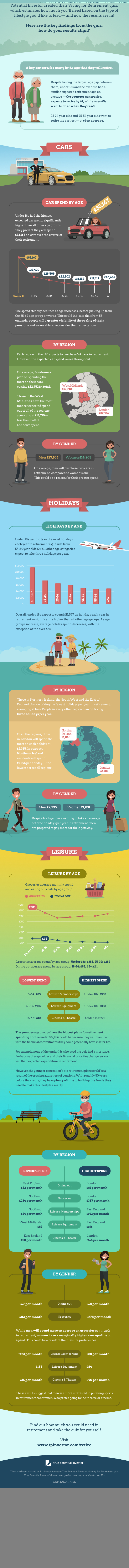

Do you see yourself driving the car of your dreams when you retire? Do you dream to drive daily along the coastline of the seaside town you purchased your retirement home in? Are any of those dreams obtainable? Online investment company, True Potential Investor, has produced a study with findings on attitudes to retirement and how much money is needed to save for the perfect retirement.

Their most interesting finding identifies that, whilst retired, on average men expect to purchase two cars which amounts to 27K on average. This is on top of all the other costs they have to bear during retirement, especially if they have no one to take care of them. Usually, retirees save up by selling their homes and moving into a smaller apartment or an independent senior living community so that they could instead spend on more enjoyable things like cars and other hobbies. This is compared with women who expect to purchase just the one car, totalling at 14K. Those amounts are very close to the average amount people save for their retirement. All the more reason to start saving now.

And there are plenty of ways to save up for your retirement, don’t just put all your eggs into one pension pot basket. You could invest in Independent Reserve Ethereum or stocks to earn money that you could put into a single-access ISA which could increase your savings over time.

Alternatively, you could also open an IRA as a sort of investment pot to put a bit of money into every now and then. Not only does such an account have great tax advantages, but it also offers great investment prospects, such as stocks, bonds, mutual funds, or gold. Be sure to research various prospects and custodians like Bullion Shark (full review here) and others before you settle on one. But as far as investing for retirement goes, even cars are a potential investment! While the second-hand car market can be volatile and not for the inexperienced, peer-to-peer lending of a popular car model could reel in some money.

The findings of the study have been collated via an infographic. To save you a click, here is the full infographic made by True Potential Investor. Scroll and see what the numbers are for the retirement life you want to lead.

Need help starting your retirement journey? This quiz which you can complete, here can help calculate how much you’ll need to save in your personal pension pot to cover cars, groceries and more during retirement age.